摘要:本文旨在分析预测未来原油价格的策略。通过对市场供需因素、地缘政治风险、经济指标以及能源政策等关键变量的深入研究,文章探讨了影响原油价格的多种因素。通过综合各种数据和信息,文章提出一种预测模型,以预测未来原油价格的走势。该分析对于投资者、企业和政策制定者理解并预测油价波动具有重要意义。

In the global economy, crude oil plays a pivotal role, and its price fluctuations have a significant impact on various sectors, including energy, transportation, and manufacturing. Understanding and predicting crude oil prices are crucial for businesses, investors, and policymakers. In this article, we will explore the factors affecting crude oil prices and delve into the methods used for predicting future prices.

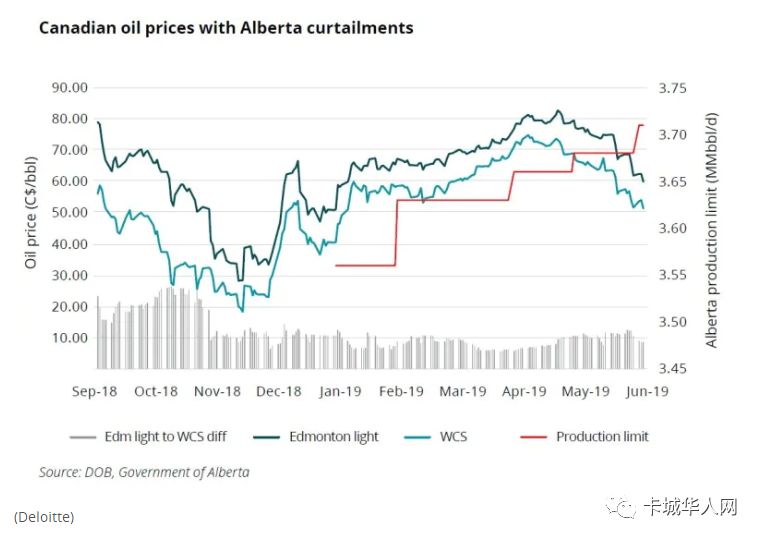

The price of crude oil is influenced by numerous factors, including global supply and demand, political stability, economic growth, and natural disasters. When the supply decreases or demand increases, the price of crude oil tends to rise. Conversely, an increase in supply or a decrease in demand leads to a decline in prices. Political instability in oil-producing countries can result in supply disruptions and price hikes, while economic growth in major consuming nations drives up demand and prices.

To predict future crude oil prices accurately, several methods are employed. One of the most commonly used methods is fundamental analysis, which focuses on analyzing the factors that affect supply and demand. By examining production levels, storage capacities, export restrictions, and other relevant factors, fundamental analysts aim to identify trends in supply and demand and predict future price movements.

Another method used in predicting crude oil prices is technical analysis. Technical analysts study price charts and market trends to identify patterns that indicate future price movements. They analyze past price patterns, trading volume, and other market indicators to develop strategies that can help predict future prices.

Artificial intelligence and machine learning algorithms are increasingly being used in predicting crude oil prices. These algorithms analyze vast amounts of data, including historical price data, global economic indicators, political events, and other relevant factors. By identifying patterns and trends, these algorithms aim to provide accurate predictions about future crude oil prices.

However, predicting crude oil prices accurately is challenging due to the complexity of the global economy and the numerous factors that influence prices. Oil markets are highly volatile and can be affected by unexpected events such as political crises or natural disasters. Therefore, even with advanced prediction methods, there is always a margin of error in predicting future prices.

Moreover, it's important to consider the impact of alternative energy sources on crude oil prices. As renewable energy sources become more prevalent and efficient, the demand for crude oil may decrease, leading to lower prices. On the other hand, advances in technology may lead to increased demand for crude oil, especially for specific industries like transportation and chemicals.

In conclusion, predicting future crude oil prices is a complex task that requires an analysis of numerous factors. By understanding the factors that affect prices and using advanced prediction methods like fundamental analysis, technical analysis, and AI-based algorithms, investors and businesses can make more informed decisions about their investments and strategies. However, it's crucial to remain vigilant and flexible as global events can always lead to unexpected price movements.

京公网安备11000000000001号

京公网安备11000000000001号 京ICP备11000001号

京ICP备11000001号