摘要:联邦机构决定提高利率的原因主要包括控制通胀压力、稳定经济增长和平衡金融市场。此举旨在通过控制货币供应和信贷规模来减缓通胀压力,同时确保长期经济增长的稳定性。提高利率还有助于平衡金融市场,降低金融风险,维护金融市场的稳定和健康。这一决策也带来了一些挑战,如可能对房地产市场和消费者信心产生影响。提高利率是出于对经济和市场健康的综合考量。

The Federal Reserve, commonly known as the Fed, is the central banking system of the United States. Its primary responsibility is to regulate the nation's monetary policy, including the setting of interest rates. Recently, the Fed has announced an increase in interest rates, a decision that has significant impacts on the economy and financial markets. This article will explore the reasons behind this decision.

1、Economic Recovery and Growth

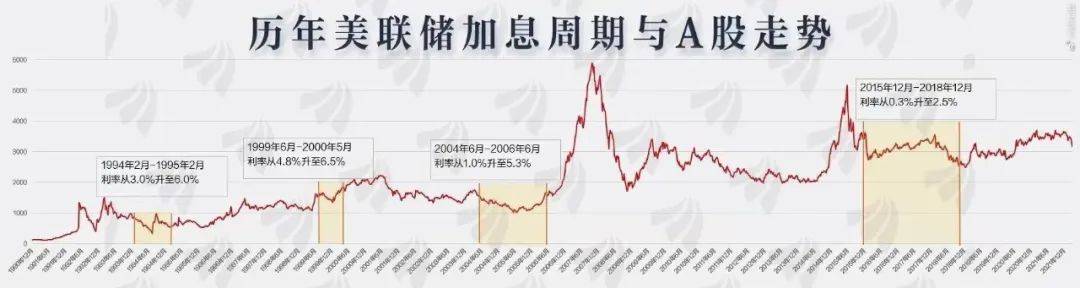

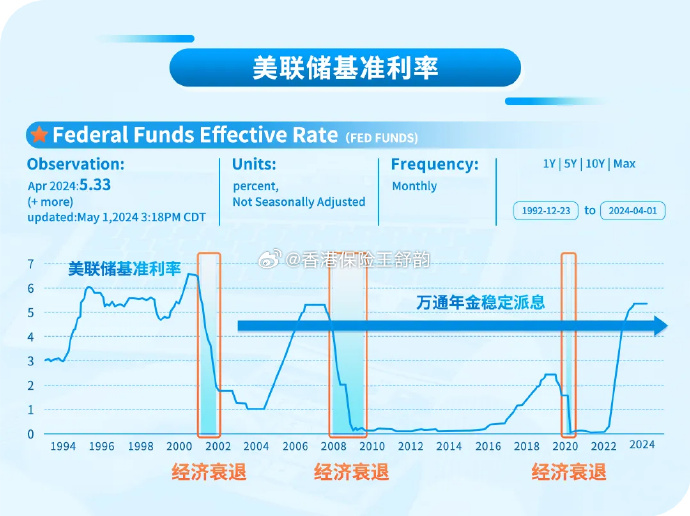

One of the main reasons for the Fed's interest rate increase is the economic recovery and growth in the United States. The economy has been expanding for several years, and the Fed wants to ensure that this growth continues. By increasing interest rates, the Fed is trying to slow down the pace of borrowing and spending, which can help to prevent overheating of the economy. This is a precautionary measure to ensure that the economy remains on a sustainable growth path.

2、Inflationary Pressures

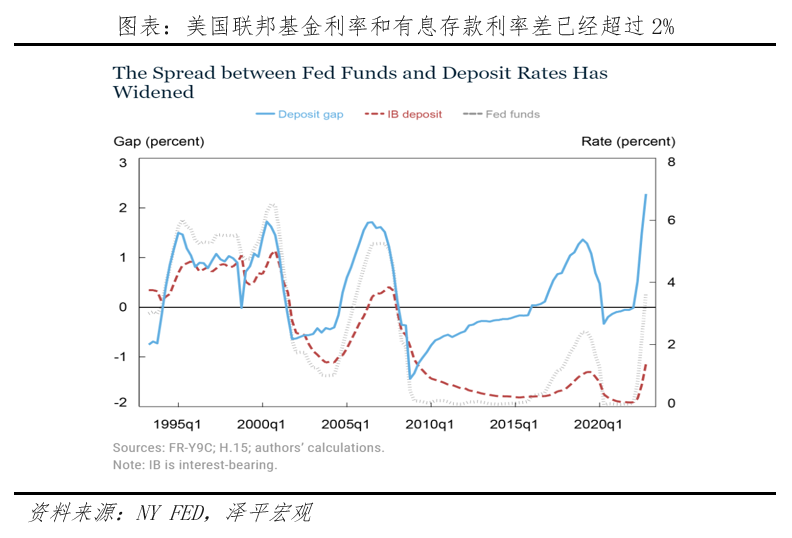

Another reason for the Fed's decision to increase interest rates is inflationary pressures. Inflation is a rise in prices across the economy, which erodes the purchasing power of money. The Fed aims to keep inflation under control to ensure price stability and maintain the value of the currency. By increasing interest rates, the Fed can reduce the amount of money circulating in the economy, which can help to bring down inflationary pressures.

3、Labor Market Tightness

The strength of the labor market is also a factor in the Fed's decision to increase interest rates. As the economy has expanded, the labor market has become increasingly tight, with fewer job openings than there are workers seeking employment. This tightness puts upward pressure on wages, which can lead to higher prices and potentially higher inflation. By raising interest rates, the Fed can help to cool the labor market and prevent wage inflation from spiraling out of control.

4、Global Economic Conditions

The global economic conditions also play a role in the Fed's decision to increase interest rates. The United States is not an island; its economy is closely linked to global economies. The Fed considers global economic factors such as other central banks' policies, global trade conditions, and global inflation when setting interest rates. As other central banks have begun to tighten their monetary policies, the Fed has also moved to increase interest rates to maintain consistency with global economic policies.

5、Financial Stability and Risks

Lastly, the Fed considers financial stability and risks when making decisions on interest rates. The financial system is complex and interconnected, and any instability can have significant impacts on the economy. By increasing interest rates, the Fed can help to stabilize the financial system and reduce risks associated with excessive borrowing and lending. This is particularly important given the high levels of debt in the economy and potential risks associated with asset prices.

In conclusion, there are several reasons behind the Fed's decision to increase interest rates. The economic recovery and growth, inflationary pressures, labor market tightness, global economic conditions, and financial stability and risks are all factors that influence the Fed's decision-making process. By increasing interest rates, the Fed aims to ensure sustainable economic growth, maintain price stability, and reduce risks associated with excessive borrowing and lending. However, it is important to note that interest rate decisions are complex and involve balancing various factors to ensure that they have a positive impact on the economy as a whole.

京公网安备11000000000001号

京公网安备11000000000001号 京ICP备11000001号

京ICP备11000001号